Are current LIS and LIMS prepared for the coming flood of personalized medicine data?

By Steve Halasey and Gary Tufel

Among all the business entities and organizations that make up the world’s sprawling healthcare systems, clinical laboratories are among the heaviest users of information technologies (IT). Recognizing the utility of IT systems almost as soon as they came into being—now more than 30 years ago—clinical labs have played a key role in defining the needs for such systems, and giving shape to their embodiment in a variety of self-standing and interconnected programs and software applications.

Today, most clinical labs are familiar with the use of laboratory information systems (LIS) that simplify tasks related to lab administration and instrumentation, and laboratory information management systems (LIMS) that facilitate the collection, storage, and distribution of patient test results and other data. Initially defined as a series of separate programs with distinct functions—one program for capturing instrument performance data, another for billing, a third for interfacing with the systems of other organizations, and so on—LIS and LIMS have gradually become full-service integrated systems that are capable of seamlessly performing a wide range of functions. In recent years, even the lines between LIS and LIMS themselves have become blurred, as each type of system has captured more and more of the other type’s traditional functions.

But in the current climate for clinical laboratories, there is reason to wonder whether the makers of full-service LIS and LIMS are able to keep up with the growing specialization and sophistication of clinical laboratories and their demands for advanced IT capabilities. With the increasing use of molecular diagnostics—including next-generation sequencing (NGS) systems capable of spinning out terabytes of patient data and analyses in ever-shorter timeframes—clinical labs are finding new reasons to rethink their approach to IT. Add on top the gradual emergence of digital pathology, with its own needs for data-heavy imaging storage and analytical processing, and you have a recipe for a field in tremendous flux.

For makers of both full-service and specialty-focused LIS and LIMS, the coming tsunami of personalized medicine data could represent an unparalleled opportunity to create new, advanced systems that will capture even more laboratory clients. But first, they have to be in a position to ride the wave instead of being swept away by it.

Does Integrated Equal Antiquated?

According to some observers, the 30-odd-year-old market for LIS and LIMS is now fully mature, with the result that labs are mostly now locked into the vendors that they selected years or even decades ago. Moreover, say these observers, it’s so difficult to change software systems that labs would rather stay with a system that they know to be inadequate than try to improve by moving to another system.

In some healthcare organizations, labs may feel locked-in or even neglected when enterprisewide solutions are adopted without input from lab leaders. “There are two common scenarios: labs that are forced to use an unsuitable enterprisewide system instead of installing a best-of-breed system designed for lab use; and labs whose concerns are last on a long list of needs within a large healthcare organization, and are therefore stuck with whatever system they have,” says Kim Futrell, MT(ASCP), marketing products manager at Orchard Software Corp, Carmel, Ind. “Organization administrators may adopt the view that their selected system is working just fine, making it the responsibility of the lab to show that potential returns would justify an investment in replacing the system. Or, perhaps, to identify an LIS that saves money in the long run through cheaper ongoing support.”

But rushing to the lowest-cost solution can have serious consequences. “Many vendors have a fire-and-forget policy with respect to their customers, relying on inertia to keep their systems in use for a number of years and, after that, not really caring if the lab switches to a different LIS,” says Janet Chennault, MT(ASCP), vice president and cofounder of Schuyler House, Valencia, Calif. “We have come across sites where the vendor did not even make a pretense of supporting their existing system after the sale was complete—and we have replaced many of those systems.”

Not everyone sees the maturity of the LIS and LIMS marketplace as a negative. “Not only is the industry mature and the market saturated—that is, most labs already have an LIS—but the software itself has also had time to mature,” says Futrell. “By way of comparison, the market for electronic medical records (EMRs) is quite immature—just 10 or 15 years old—and physicians across the board are displeased with the functionality of EMR systems. LIS have been around much longer, and are much more advanced and integrated systems.”

“When large vendors talk about the LIS market in the United States, they are typically concerned only with hospitals having more than 100 beds and a handful of major reference labs,” says Chennault. “Within that context, the observation that the LIS market is mature and almost immutable is largely correct. Those institutions’ investment of millions of dollars into what are now legacy LIS makes it difficult for them to consider changing vendors.

“But what this observation does not address are the thousands of smaller laboratories that exist in the United States, including physician office labs (POLs), small reference labs, and even small hospital labs,” Chennault adds. “These facilities sometimes lack LIS software all together. Or, if they have old systems, they can sometimes change their LIS providers for little more than the cost of maintenance payments to their old software vendor. This small laboratory market is more fluid, and is not properly labeled mature.”

“Even so, not many full-service LIS makers are able to keep up with the demand for advanced capabilities, as the LIS portion of a laboratory’s IT systems is not a primary revenue driver,” says Jeff Fisher, president and CEO of Comp Pro Med, Santa Rosa, Calif. “In a sense, the LIS is an afterthought. The LIS has to be part of a lab’s larger systems, but it isn’t a focus. So from an ongoing development standpoint, the LIS doesn’t get much attention in relation to the rest of the system. This opens the door to companies such as Comp Pro Med that specialize in LIS and can respond nimbly to the needs of their customers and the market.”

But if labs of any size or specialty can’t switch to a new system without throwing over their current vendor—potentially undoing years of refinement to optimize system performance—what incentives do vendors have to build better systems? Will labs continue to face the choice between fully integrated and best-of-breed systems, neither of which is entirely satisfactory or readily upgradable?

“There is really a place for both approaches,” says Conor Ward, director of sales at Xifin Inc, San Diego (see Figure 1). “Many full-service LIS/LIMS providers are focusing on toolsets that provide for flexibility in workflow configuration, user interface design, and report development. This approach allows the laboratory to add new testing lines through configuration, without having to acquire a new purpose-built LIS.”

“Representing just 3% of the nation’s overall healthcare costs, labs have already squeezed out a tremendous amount of inefficiency—and a lot of that achievement is due to their adoption of LIS,” says Futrell. “But today, the LIS and LIMS market has moved way past developing central functionality. LIS and LIMS makers are now developing changes that enable their systems to support efficient lab workflow, and to help labs integrate with broader healthcare organizations. We’re into the details now, continuing to make improvements based on customer feedback.”

Nevertheless, says Chennault, “upgrades do not per se provide new utilities; they may be just bug fixes. And obtaining even those limited improvements may cost a site a considerable percentage of their purchase price, potentially up to 100%. New abilities and features are separately priced and come in addition to an upgrade.”

Whether or not they want to make a change, labs can find themselves needing to switch to a system other than what they have been using. Regulatory burdens represent powerful levers that can cause even mature laboratories to switch vendors, unless the software companies provide additional capabilities. “A recent example of this effect is the long-delayed US switch to the new system for the international classification of diseases (ICD-10),” says Chennault. “Suddenly, in order to stay in business, all of an institution’s software had to become ICD-10 compatible—or the institution switched to a different LIS.”

“Another key factor that is driving scalable advances in LIS and LIMS is open connectivity,” says Xifin’s Ward. “A scalable LIS/LIMS has to have a documented application programming interface for data exchange with third-party systems such as billing, EMR/EHR interface hubs, laboratory instrumentation, and laboratory data warehouses, to name just a few. An LIS/LIMS with a narrow best-of-breed approach can also fit into the lab IT ecosystem so long as it can be tightly integrated to avoid creating multiple data silos within the lab.”

“What’s key here is for lab leaders to be involved and develop the respect of their organization’s administration, so that their opinions are sought out and considered when decisions affecting the lab are being made,” says Futrell. “A strong lab manager who feels stuck with systems that do not meet the needs of the lab or its parent organization should be very vocal, but should also prepare a well-reasoned and professional business proposal to justify shifting to a different LIS, and to identify several that should be considered.”

Not a Silo, a Specialty

Another class of laboratories that the “mature market” theorem fails to address is startup specialty laboratories. According to Chennault, the dominant trend in that market currently favors toxicology and pain management specialties, but over the next few years that emphasis may well switch to molecular or genetics labs.

“These laboratories fulfill a newly seen need in the medical industry and often find a sweet spot for reimbursement as the payment schedule lags behind improvements in instrumentation technology,” says Chennault. “Because the United States provides a good environment for medical entrepreneurialism, niche laboratories can quickly spring up to fill a need that was not foreseen even a handful of years ago.”

In many cases, responding to newly identified needs involves changing the settings in which lab testing is performed. “As mergers and consolidations cause smaller labs to close, larger labs with greater economy of scale are taking over testing,” says Futrell. “This is likely the direction of the market—large labs doing the majority of testing, and only urgent or point-of-care testing taking place in smaller healthcare facilities.

“What we end up needing is still a dedicated and highly specialized LIS/LIMS that is able to handle all lab functions and be interoperable with any other information system or health information exchange in an organization’s network, as well as a system that integrates point-of-care testing,” Futrell adds.

“NovoPath’s clients are global, and they span the medical, veterinary, and research market segments,” says Rick Callahan, vice president of sales and marketing at NovoPath, Princeton, NJ (see Figure 2). “So even when particular product features and functions are not required for the US medical market, they may be required in another part of the world or in another market segment.

“Although NovoPath is uniquely focused on anatomic pathology, we recognize that we have a wide variety of clients. Consequently, we often accept requests for customization—even those specific to an individual lab—and we develop the requested features so that we can bring them to the general US market, if appropriate,” adds Callahan. “For example, NovoPath is adaptable to many different languages worldwide. In the United States, this capability enables us to provide pathology reports in a variety of languages, and to send correct-language versions to a pathology practice that serves, for instance, both English- and Spanish-speaking clients.

“NovoPath continues to refine its Lean process management and specimen-tracking modules,” says Callahan. “These modules offer labs the utmost flexibility to use Lean principles for addressing the need for cost reduction, and for using specimen-tracking capabilities to ensure patient safety,” says Callahan. “We’re also focusing on the growing markets for molecular pathology.”

The changing roles of LIS and LIMS in relation to shifting policy and market trends can also leave labs wondering about their best IT options. “It is tricky to determine what an LIS can do,” says Chennault. “The healthcare sector is generally conservative, and tends to operate in the mode that ‘everything that is not required is forbidden.’ If an LIS produces analyses of patient data, does that constitute a ‘diagnosis’? Until recently, patients were forbidden to receive directly the results of their own tests, but now it is required that patients be able to access that information. What to do? What to do?”

Across the Board Advances

However mature the laboratory IT market may be, it’s clear that the makers of both full-service and best-of-breed LIS and LIMS intend to continue innovating for the benefit of their clients—present and future (see “Delivering the News“). But in the quest to advance the capabilities of their LIS and LIMS products, companies are pursuing a widely varied range of opportunities.

“Strong vendors are not throwing in the towel because the landscape is changing and business has gotten a little tougher,” says Futrell. “Instead they are strategically planning how to address the changes that are going on in the market. At Orchard, for instance, we foresee big growth in point-of-care testing, so we are developing and installing an enterprise management and connectivity solution to help labs in that area.

“Best-of-breed LIS vendors are all over these opportunities, working to develop systems that can handle molecular diagnostics as well as anatomic and digital pathology testing,” says Futrell. “At Orchard, we are listening to our customers continually, and putting in the software the features they ask for. We are working to be able to better deal with molecular diagnostics, and we are developing an enterprisewide LIS that will make use of all the recent developments in lab testing, including an element of big data storage.”

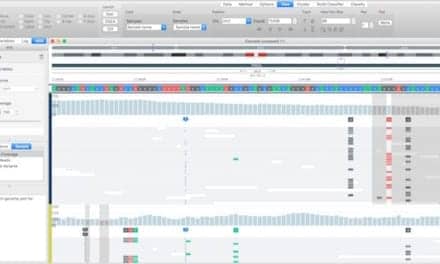

“Xifin is focusing on scalability,” says Ward. “Our development of workflow tools and the expansion of our application programming interface have been critical as we have built out next-generation sequencing and clinical capabilities.

“Incorporating business intelligence dashboards and reports is another area of emphasis that sophisticated laboratory end-users are requiring,” adds Ward. “Xifin is also partnering with leading industry connectivity providers such as Ellkay and Data Innovations to deliver a comprehensive integration strategy with EMR/EHR and instrument vendors.”

“Comp Pro Med is very responsive to the needs of its customers. One important area is our charge code accounting module,” says Fisher. “With narrower healthcare networks, shrinking budgets, and the coming influence of the Protecting Access to Medicare Act of 2014 (PAMA), accurate billing is taking on a more important role for labs. Our module helps to bridge the gap between the lab and its billing office, especially as it relates to what tests are ordered versus what the lab actually does. This module ensures that the lab bills for everything it does, and in the right way for maximum allowable reimbursement.”

Sometimes, LIS and LIMS providers need to take a roundabout route to advancing the field. NovoPath’s Callahan cites the example of his company’s approach to the emerging field of telepathology. “As a best-of-breed anatomic pathology LIS, NovoPath tends to be ahead of the demand curve for advanced capabilities. But in the United States, digital pathology tests cannot be used to form a primary diagnosis, essentially limiting the use of this advanced technology to secondary diagnoses, or to research and education,” he says.

“However, in the veterinary pathology market, and in most other global medical markets—including Canada and Europe—digital images may be used for primary diagnosis,” he adds. “Since NovoPath serves those markets, we’ve been able to refine our interfacing to whole-slide imagers to the extent of providing a much-desired telepathology module. Today, this module positions NovoPath for the future telepathology market in the United States, once digital pathology for primary interpretation is approved.”

Conclusion

“All LIS systems have to choose between struggling to keep up with new markets or accepting that their client base will dwindle,” says Chennault. “Some systems have been able to market scant software capabilities on the basis of price alone, but most LIS vendors are always reaching to develop ‘the next thing’ that the market wants.”

“Hopefully, labs made careful decisions when they selected their current LIS/LIMS partners,” says Futrell. “But if not, it may be time to look for an LIS partner that has its eye on the rapid-fire changes taking place in healthcare, and is intending to continue developing products to meet future needs.”

Steve Halasey is chief editor of CLP; Gary Tufel is a contributing writer. For further information contact Steve Halasey via [email protected].

Nice blog posting.