The donated equipment will be distributed to clinics and health projects serving poor and underprivileged people in need of medical aid around the world. Direct Relief estimates the Midmark’s donation at more than $2 million wholesale. Sterilizers have rarely been donated in the past, and never in large quantities, but recipients of the used equipment often need and request them.

The contribution is a result of a sterilizer buy-back program initiated by Midmark Chairman and Direct Relief board member, Jim Eiting. Individuals who buy new Midmark sterilizers trade in used ones and receive a discount on the purchase. Used sterilizers are shipped back to Midmark, and then forwarded to Direct Relief where they are refurbished and sent to healthcare facilities around the world.

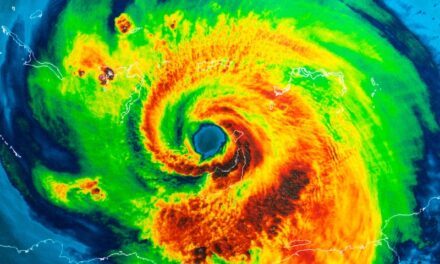

Sterilizers from Midmark have been sent to hospitals and clinics in Albania that provided care for refugees from Kosovo, to facilities in Central America that are rebuilding after Hurricane Mitch, and to healthcare organizations in Brazil, Cambodia, Columbia, Estonia, Guyana, India, Malawi, Mexico, Peru, the Philippines and Romania.

Careside and Quest terminate exclusive contract and explore point of care opportunities

Careside Inc. of Culver City, Calif., and Quest Diagnostics of Teterboro, N.J., have terminated the exclusive distribution and supply contract they both inherited when Quest acquired SmithKline Beecham Clinical Labs in 1999. However, the two are still discussing possible future uses of Careside products in Quest laboratories.

Careside was an offshoot of SmithKine. Careside informed Quest that it was nearing attainment of all developmental milestones for contract activation, while Quest informed Careside that it is not prepared for contract activation. Quest would have had to meet specific purchase obligations upon activation of the contract. Quest, which has been focused on consolidation activities, has not completed its analysis and plan for point-of-care adoption.

The companies discussed canceling the contract and Quest exercised its right to do so. As a result, Careside is relieved of the exclusivity clauses that have prevented it from negotiating with other reference labs.

Careside is assisting Quest in its evaluation of the POC market and Careside’s POC technology.

W. Vickery Stoughton, Careside chairman and CEO, said the company has never included revenues from the Quest contract in its financial planning, and that it is continuing to aggressively pursue market opportunities. Careside technology provides a platform for routine chemistry, coagulation and hematology testing. The point-of-care Careside Analyzer encompasses 38 FDA-cleared or exempt tests.

GLUT1 may identify cancer cells in uterine lining cells

In a new study, researchers at the Mount Sinai School of Medicine in New York, found that screening uterine cells for the glucose-carrying protein GLUT1 may help identify cancer cells or potentially cancerous cells.

Researchers stained 116 samples of endometrial cells, either benign, malignant or of undetermined nature, with a solution that reacts with GLUT1. In the June 15th issue of the Journal Cancer they reported that the malignant samples tested positive for the protein. Staining also was positive in cases of atypical hyperplasia.

None of the benign samples tested positive. Simple hyperplasia cells, which are unlikely to become malignant, tested negative for GLUT1.

The researchers said endometrial cells that test positive for GLUT1 appear to be at high risk for progressing to cancer. In place of the current system of classifying growths in the endometrium, they suggested eventually using a simpler system of classifying cells on whether they test positive for the protein.

However, in an interview with Reuters Health, Burstein said the findings are preliminary, and that he hoped other researchers would be able to confirm the findings in future studies. He noted that there may be several other biological markers that might be used to aid in the determination of the nature of unusual growths in the endometrium.

National laboratory testing and information service provider LabOne, Inc. of Lenexa, Kan., and Epitope, Inc. of Beaverton, Ore., have signed an agreement to jointly develop and commercialize an oral fluid screening test for Hepatitis C antibodies. Epitope manufactures diagnostic products using its proprietary oral fluid technologies.

The test will feature Epitope’s OraSure oral fluid collection device, which is used to test for HIV-1 antibodies and for five common drugs of abuse.

Outside development and clinical study costs will be covered by LabOne which also will provide lab testing services with the goal of obtaining FDA clearance for use in public health markets in a year. For five years following development, LabOne will be the exclusive laboratory for oral fluid screening of Hepatitis C antibodies for U.S. customers.

Robert Thompson, president and CEO of Epitope, said an oral test for Hepatitis C will encourage greater patient participation because it eliminate the fear of needles and the danger of needlestick injuries.

| Premier’s 1,900 hospitals can look forward to electronic purchase of Dade lab products Dade Behring Inc. of Deerfield, Ill., and Premier, Inc., of Charlotte, N.C. will collaborate on an Internet purchasing and information initiative aimed at making Dade’s lab products available to Premier’s 1,900 member hospitals through medibuy.com, Premier’s exclusive e-commerce marketplace. Dade Behring CEO Steve Barnes said the collaboration is the natural next step in helping suppliers and customers create value for their members. Premier, through its Purchasing Partners supply chain services organization, develops group-buying arrangements for use by its member hospital and health systems. These group arrangements include group contracts with set pricing and organized buys targeted to market dynamic pricing. The purchasing program uses medibuy.com as an electronic commerce infrastructure for budgeting, sourcing and purchasing supplies, services and equipment. Herb G. Johnson, executive vice president of Premier, said Premier has selected medibuy.com’s e-commerce solutions to complement and provide electronic infrastructure in support of group purchasing and to begin to address the waste within the healthcare supply chain. |

Nucleic acid isolation and purification drive diagnostics industry boom, study says

According to an international market consulting firm, as the genetic basis of disease is better understood, more tests are being developed to determine an individual’s genetic susceptibility to disease.

This has left healthcare providers with the opportunity to provide preventative treatments that can improve patient care and save the money by reducing treatment costs. Research from Frost & Sullivan, a Silicon Valley-based firm that monitors market trends, indicates that the market for genetic testing has grown by about 50 percent over the past two years, and that many labs have been unable to accommodate the large increases in sample numbers. As a result, they are forced to outsource the overflow to other facilities, reducing lab revenue. As sample numbers continue to increase, the study said many labs will have to consider ways to increase their throughput.

Traditionally, the nucleic acid diagnostics industry has been product driven, but companies such as Qiagen of Valencia, Calif., are shifting the focus away from product and toward strong service. The service component is taking the form of reagent rental programs, which are seen throughout the diagnostics industry, according to Frost & Sullivan.

The effectiveness of this competitive strategy has been demonstrated outside the clinical market by PE Biosystems of Foster City, Calif., in research done by Frost & Sullivan titled, “U.S. Nucleic Acid Isolation and Purification Markets.” In both markets, the company holds more than 90 percent market share, which is attributed largely to the acquisition of its top competitor Perceptive Biosystems.

With consolidation and shifting market dynamics, it is vital that diagnostic companies offering only instruments or reagents form strategic alliances to increase their product line. A failure to do so may result in a market share loss to companies offering solutions to nucleic acid isolation and purification.

Companies that participated within the industry included Qiagen Inc., Roche Diagnostics Corp./Molecular Division, Roche Diagnostics Corp., Promega Corp., Life Technologies Inc., Pierce Chemical Co., PE Biosystems, Organon Teknika Corp., Becton Dickinson/Healthcare Division, Abbott Laboratories/Diagnostics Division, Gentra Systems Inc., AutoGen Inc., CRS Robotics Corp., Stratagene and Sigma Aldrich Chemical.